A Comprehensive Guide to Debt Relief & Financial Freedom

Are you struggling with payday loan debt in Texas? If so, it can feel overwhelming, like being caught in a relentless cycle of high interest and escalating payments. Many Texans find themselves trapped, searching desperately for a way out. If you’re facing calls from collectors, worrying about your next payment, or feeling lost, know that you’re not alone, You can achieve payday loan help in Texas.

The answer is yes, you can get payday loan help in Texas is available. This guide is specifically designed for Texas residents, offering clear and actionable strategies and resources to help you break free from the burden of payday loans and reclaim your financial stability. We’ll explore everything from understanding Texas payday loan laws to effective debt relief solutions tailored for our state.

Understanding Payday Loans and Texas Regulations

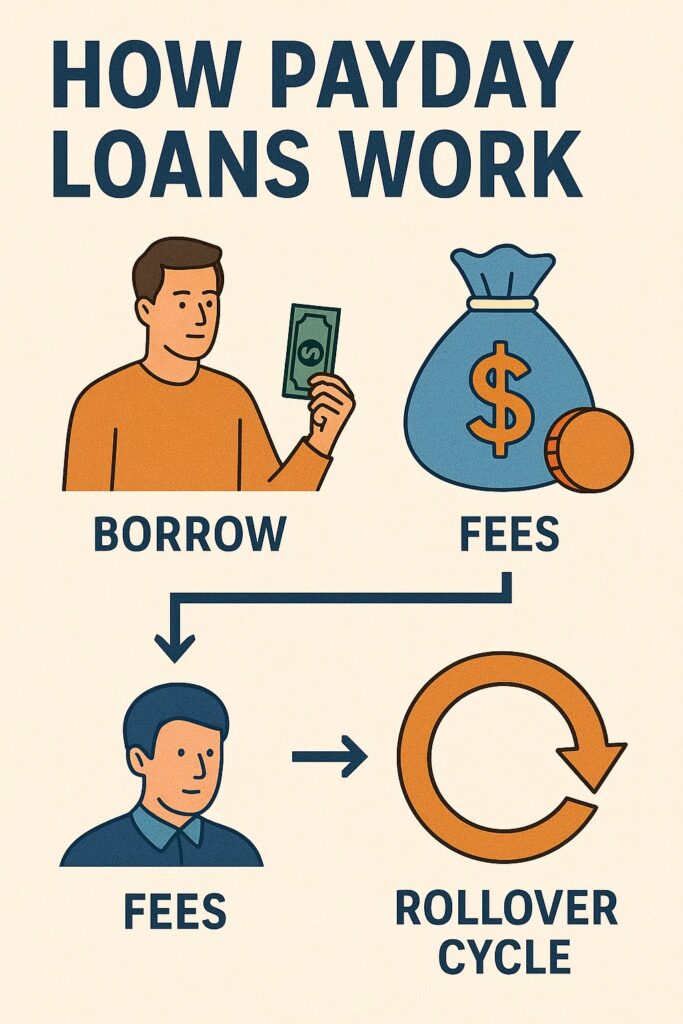

How Payday Loans Work

Payday loans, often marketed as quick cash solutions, are short-term, high-cost loans typically due on your next payday. While they can seem like an easy fix for immediate financial emergencies, their exorbitant interest rates (APR can reach 400-600% in Texas) quickly lead borrowers into a difficult debt cycle.

Texas Payday Loan Laws

Texas Specifics: It’s crucial to understand the regulatory landscape in the Lone Star State. Texas does not cap interest rates on payday loans, allowing lenders to charge exceptionally high fees. However, there are regulations regarding rollovers and disclosures. Understanding your rights and these specific Texas payday loan laws is the first step toward finding effective payday loan debt relief in the state of Texas. Are you aware of the true cost and the potential for a debt trap?

Signs You Need Payday Loan Debt Help in Texas

Recognizing when you need assistance is critical. If any of this sounds familiar, it’s time to seek payday loan assistance in Texas.

- You’re taking out new loans to pay off old ones, creating a “rollover” cycle.

- High-interest payments are consuming a significant portion of your income.

- You’re receiving constant collection calls from payday lenders.

- Your financial stress is impacting your daily life, work, or family in cities like Houston, Dallas, Austin, or San Antonio.

- You’re worried about legal action, though debtors’ prison for unpaid loans is illegal in Texas.

- You have bad credit, but still need a viable financial solution.

Impact on Mental Health and Family Stability

Debt can have a profound impact on mental health and family stability. Constant financial strain often leads to anxiety, depression, and chronic stress, which can erode self-esteem and create feelings of hopelessness. These emotional burdens frequently spill over into family life, fueling conflicts, communication breakdowns, and emotional withdrawal. Parents under financial pressure may experience feelings of guilt or irritability, which can affect their ability to provide stability and emotional support for their children. Over time, unresolved debt-related stress can strain relationships, reduce overall well-being, and make it harder for families to work together toward recovery.

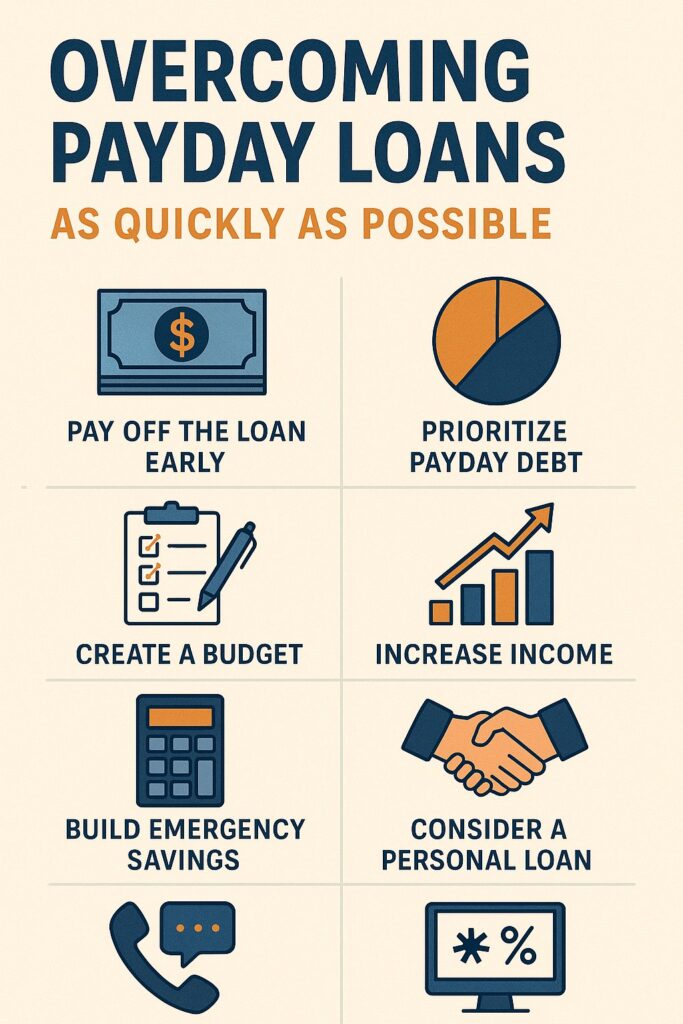

Proven Strategies for Payday Loan Relief in Texas

Don’t despair! There are several proven pathways to overcome payday loan debt. These options offer legitimate payday loan assistance in Texas and can help you regain control.

Payday Loan Consolidation Texas

Consolidating your payday loans involves taking out a new, lower-interest loan to pay off multiple high-interest payday loans. This simplifies payments to a single lender, often with a much more manageable interest rate and extended repayment period. Many companies specialize in debt consolidation in Texas for payday loans, offering tailored programs for residents throughout the state, including those with poor credit.

Call us now at (877)734-6700 for immediate help or request a quote using the form on the right.

Credit Counseling Services in Texas and Non Profit Support

Non-profit credit counseling agencies across Texas (from Fort Worth to El Paso) offer invaluable guidance. They can assess your financial situation, help you create a realistic budget, and sometimes even negotiate directly with payday lenders on your behalf for reduced payments or interest rates. They can also connect you with other financial assistance programs in Texas.

Debt Management Plans (DMPs)

Offered by credit counseling agencies, DMPs involve working with a counselor to create a single monthly payment plan for all your unsecured debts, including payday loans. The agency then distributes these payments to your creditors. This often results in lower interest rates and waived fees, providing structured debt relief for Texans.

Understanding Your Rights and Legal Assistance in Texas

Knowing your rights is power. While Texas doesn’t cap interest, there are rules around collection practices. Harassment, threats, or false statements made by collectors are illegal under both federal and Texas debt collection laws. If you believe your rights have been violated, or you’re facing a lawsuit, consult a debt attorney in Texas. Attorneys specializing in consumer law can provide crucial legal assistance for managing payday loan debt in Texas.

Negotiating Directly with Lenders

Sometimes, a direct conversation can yield results. Contact your payday lender to explain your situation and propose a more affordable payment plan or a settlement amount. While not always successful, it’s a step worth trying before more formal interventions.

Steps To Negotiate

- Contact the lender before defaulting, if possible.

- Offer a lump sum amount or extended payment plan.

- Get all agreements in writing.

I’m a Texas borrower experiencing a financial hardship and would like to discuss payment plans or settlement options. Sample call details

Exploring Alternatives to Payday Loan Help in Texas

To prevent future reliance on high-cost loans, consider alternatives such as:

- Credit Union Loans: Often offer lower interest rates than traditional banks.

- Employer Advances: Some employers offer payroll advances.

- Community Resources: Churches, charities, or local government programs in cities like Corpus Christi or Garland may offer emergency financial assistance in Texas.

- Secured Loans: If you have collateral, secured personal loans might be an option.

Choosing Reputable Payday Loan Help Providers in Texas

When seeking payday loan assistance in Texas, it’s essential to choose legitimate and ethical providers.

Look for Non-profit credit counseling agencies, reputable debt relief companies with strong reviews in Texas, or licensed attorneys.

Beware of: Companies promising unrealistic results, demanding upfront fees without explaining services, or pressuring you into signing documents you don’t understand. Verify their credentials and check for complaints with the Better Business Bureau (BBB) or the Texas Office of Consumer Credit Commissioner.

Immediate Steps for Texans to Get Payday Loan Debt Relief

Don’t wait to address your payday loan debt. Here’s what you can do right now:

- Gather Your Information: Compile details of all your payday loans – lender names, amounts, interest rates, and due dates.

- Understand Your Budget: Know exactly what you can realistically afford to pay each month.

- Research Texas-Based Solutions: Look for payday loan consolidation companies in Texas or local credit counseling agencies.

- Seek Professional Advice: A free consultation with a debt relief expert or credit counselor can provide clarity and a personalized action plan. Many offer virtual services, serving all of Texas, from Lubbock to Brownsville.

- Credit Union Loans: Lower rates and flexible repayment.

- Employer Advances: Check HR policies.

- Community Aid: Local churches or city programs.

- Secured Loans: Use collateral for better terms.

Breaking free from payday loan debt in Texas is achievable, and you don’t have to face it alone. By understanding your options, knowing your rights, and seeking professional help with payday loans in Texas, you can navigate this challenging financial situation and build a path toward lasting financial freedom. Take the first step today – your future self will thank you.

Payday Loan Help in Texas: Your Guide to Breaking Free from Debt

RECAP

Are you a Texas resident struggling with the burden of payday loans? You’re not alone. While the Lone Star State is celebrated for its business-friendly climate and free-market policies, these very laws have, unfortunately, contributed to a challenging environment for those entangled in the payday loan industry. The widespread accumulation of debt and high default rates from payday loans often push individuals and families into deeper financial distress. For Texans, a critical concern is the notable lack of comprehensive state-level protection for borrowers, making it especially difficult for many to find the help they desperately need. The good news is, this landscape is beginning to change, and effective solutions are available right now.

Do Payday Loans Help Your Credit Score in Texas?

No, payday loans typically do not help your credit score; in fact, they can often have a negative impact. This is a common misconception for many Texans seeking financial solutions. Here’s why:

- No Positive Reporting: Most payday lenders do not report timely payments to major credit bureaus. This means that even if you diligently pay off your loan, it won’t help you build a positive credit history.

- Negative Impact from Defaults: If you default on a payday loan, the lender can report this to credit bureaus. This will significantly harm your credit score, making it harder to obtain future loans, credit cards, or even housing in Texas.

- Cycle of Debt & High Costs: Payday loans are notorious for their exorbitant interest rates and fees. This structure makes it incredibly challenging for many Texans to make timely payments, leading to a vicious cycle of reborrowing or loan extensions. This cycle further strains your finances and can indirectly harm your credit as you struggle to manage other financial obligations.

For these reasons, payday loans should always be considered a last resort. If you’re struggling, it’s crucial to seek professional payday loan help in Texas to minimize their negative impact on your financial future and avoid aggressive collection agencies.

Can Texans Get Real Payday Loan Help? The Power of Debt Consolidation

Yes, Texans can absolutely get effective payday loan help! While legislative changes are evolving, immediate and proven solutions exist. One of the most impactful ways to tackle payday loan debt in Texas is through debt consolidation.

A skilled debt consolidator can serve as your advocate, working directly with your payday lenders to:

- Reduce Interest Rates: Consolidators often negotiate significantly lower interest rates, cutting down the total cost of your debt.

- Lower Monthly Payments: By combining multiple payday loans into a single, more manageable payment, your monthly financial burden can be greatly reduced. This provides much-needed breathing room.

- Simplify Repayment: Instead of juggling several due dates and lenders, you’ll have one straightforward payment plan.

At our firm, we specialize in helping Texans break the cycle of payday loans. We’ve assisted thousands of families across the state, negotiating on their behalf and providing a clear path to becoming debt-free. We understand the unique challenges faced by residents of Texas and are dedicated to your financial well-being, helping you avoid the relentless harassment from payday lenders.

Understanding Debt Relief Options for Payday Loan Help in Texas

Yes, various debt relief options can significantly help with payday loans. Debt relief encompasses strategies designed to either reduce the total amount of debt owed or to make the repayment terms more manageable. For Texans burdened by payday loans, key options include:

- Debt Consolidation: As discussed, this involves combining multiple high-interest debts, like payday loans, into a single, lower-interest payment. It streamlines repayment and reduces overall costs.

- Debt Settlement: This process involves negotiating with lenders to pay back a reduced lump sum, less than the original amount owed, to resolve the debt.

- Debt Management Plans: Administered by credit counseling agencies, these plans help you create a budget and make single monthly payments to the agency, which then distributes the funds to your creditors.

For payday loan debt specifically, options such as debt consolidation and debt management plans are particularly effective in combining multiple loans, reducing interest and fees, and creating a feasible pathway to pay off debt over time.

Choosing The Right Payday Loan Debt Help Company in TX

What To Look For

✅ Transparent fees

✅ Positive Texas client reviews

What to Avoid

🚫 Upfront fees without clear service

🚫 “Guaranteed results” claims

🚫 Pressure to sign documents

Government & Local Initiatives: Payday Loan Help for Texans

While state-level legislative protection against payday loan abuses has historically been limited due to strong lobbying efforts, new developments are empowering Texans at the local level. Many Texas cities have begun to pass hyper-local ordinances to establish stronger regulations and protections for borrowers within their city limits. These efforts demonstrate a growing commitment to safeguarding residents from predatory lending practices.

Additionally, specific programs and resources are available if you live in Texas and are seeking government-backed assistance for payday loan debt:

- The Texas Payday Loan Assistance Program: This program provides resources and counseling services designed to help individuals manage and address their payday loan debt.

- The Texas Office of Consumer Credit Commissioner (OCCC): they offer guidance and resources for consumers struggling with various forms of credit, including payday loans. They can provide information on borrower rights and help navigate complex situations.

It’s important to understand that while these government programs and local ordinances offer valuable support and resources, they may not eliminate your debt. They are crucial steps towards a more protected borrowing environment in Texas, a great state that continues to strive for better consumer safeguards. Whether you’re in Austin, Dallas, or San Antonio, there are safeguards in place to protect the public.

Your Path to a Debt-Free Future

Our Texas Payday Loan Consolidation Program

Since 2008, we’ve built a strong working history with every TX lender, providing unparalleled experience in navigating the complexities of payday loan debt in Texas. If you are a Texan with payday loans and need genuine, effective assistance, our proven payday loan consolidation program is designed to deliver the relief you deserve.

Don’t let the cycle of payday loans control your life. Take control today. Contact us to learn how our dedicated team can help you consolidate your payday loans, reduce your payments, and achieve financial freedom. Repay your payday loans and finally be debt-free!